Payments

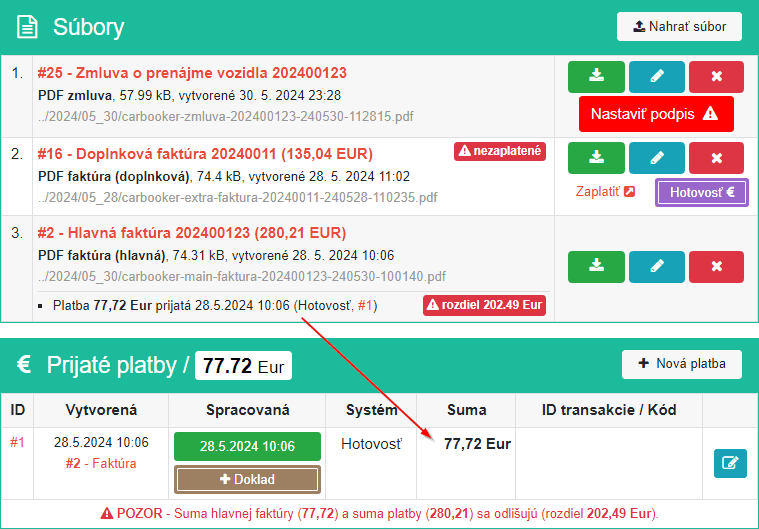

Received payments are automatically assigned to orders where they can be reviewed by an administrator. A warnig message will be displayed in case sum of received payments differs from order price.

Fig. 1 - Order detail - received payments with a warning message if the total sum differs from order price

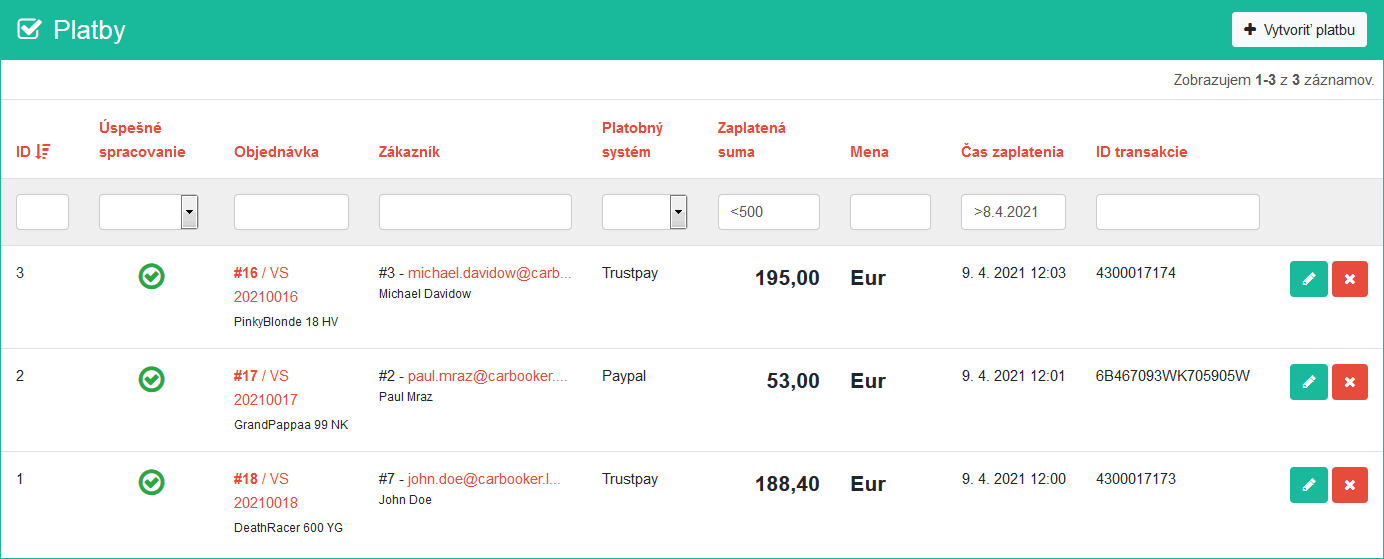

Since payment management is extremely sensitive to accuracy and requires fine tuned editing options, administrators have the ability to search and manage payments also in the global list. The list supports various filtering criteria - e.g. by amount, payment system, processing date, etc. A payment may be also created and assigned to order manually.

Fig. 2 - Payments (click to enlarge)

Deposits

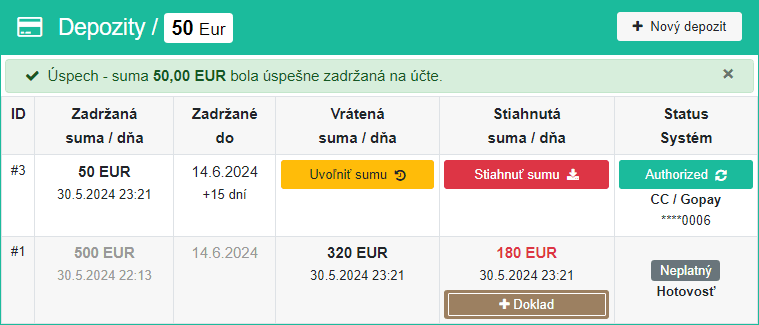

Deposits as retention payments for possible damage to the vehicle can be acquired as wire transfer, cash or pre-authorized payment, if the payment gateway supports it. It is possible to capture a part or the full amount from the withheld deposit and issue an accounting document for it (payticket).

Fig. 3 - List of deposits

Deposits in practice

In practice, the retention of money on the account is regulated by EU directives and providers of payment gateways as well as payment card issuers are bound by their compliance. According to the directives, the maximum retention period for a standard pre-authorized online payment is no more than 4 - 5 days within the entire EU. After expiration, the bank will automatically release retained funds on the customer account.

However, this is often insufficient for rental companies if they rent cars for longer time. In such a case, an alternative option is to use a (portable) payment terminal , which allows holding funds on the customer account for up to 30 days.

The disadvantage in such a case is additional costs (cca 200 - 400 Eur annually), since the terminal is rented as an independent payment channel from online payments. The provider charges fees according to the number and type of terminals as well as the length of the rented period. The disadvantage is also the impossibility of connecting a bank account tied to the terminal with an online application - because for security reasons, banks do not provide access to the client account through the API interface, nor PUSH notifications. Information on retained or withdrawn funds from the customer account can only be entered manually in the case of payment terminals into the application.