Module "GoPay - payment gateway"

GoPay.com is a Czech company providing online payment gateway for credit cards as well as internet banking of major banks. It provides 55 payment methods, 9 currencies in 7 European countries and 12 languages.

It is the so-called multi-gateway, which means that it integrates simultaneously internet banking for several banks in one place. Instead of a merchant having to integrate each bank separately, he can just use the services of a single provider. The list of supported banks may change over time, currently supported list can be found in the Gopay site (in the middle of 2023 they are VÚB, Tatrabanka, SLSP, Poštová banka a Unicredit).

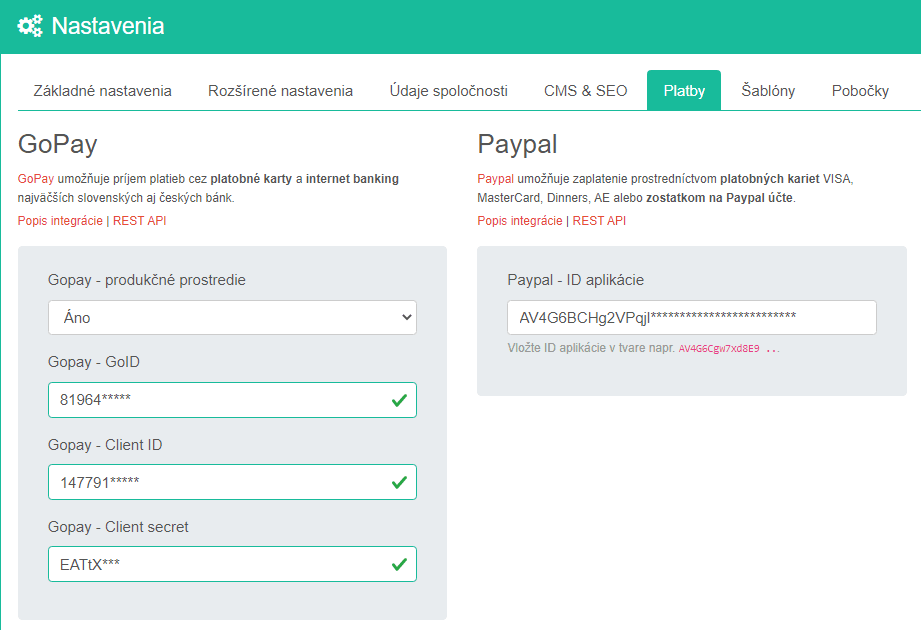

To activate payments via GoPay, API credentials for merchant account must be set in Settings. CarBooker only supports newer API version (v3 REST API, not the older SOAP version), for which parameters GOID, ClientID and ClientSecret are mandatory. These will be granted to merchant after signing the Service contract. After entering API credentials, the GoPay payment gateway will start showing up on the Payment page.

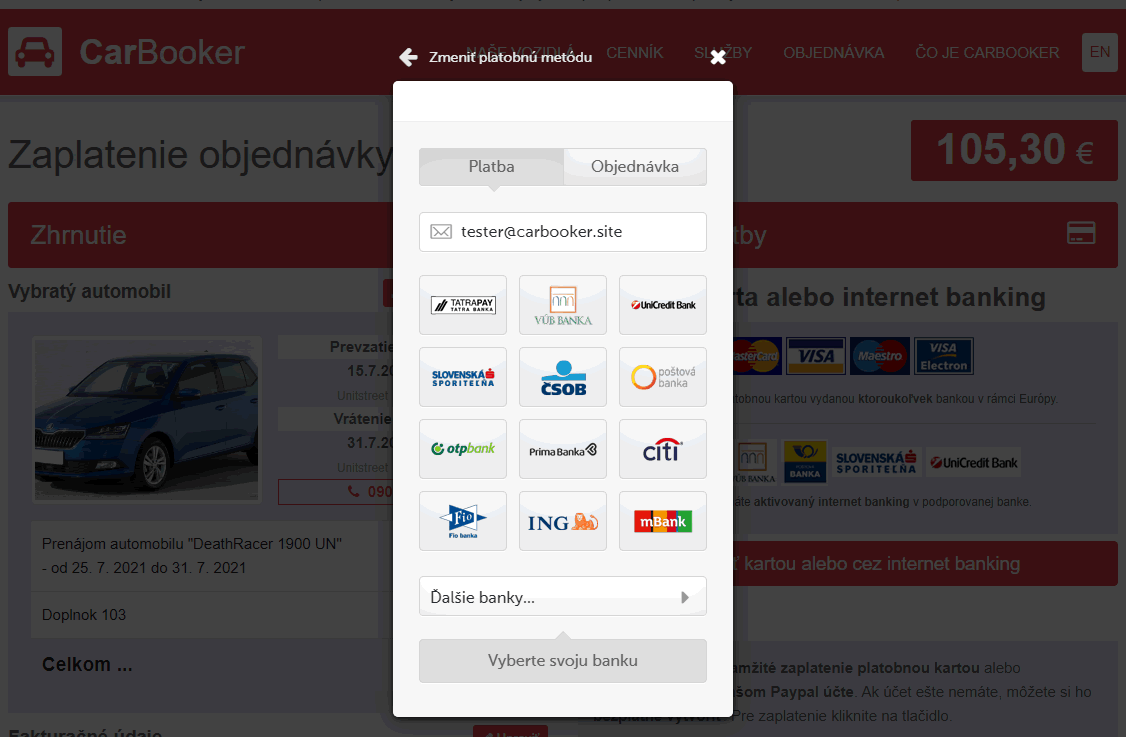

Fig. 1 - GoPay - API credentials and inline payment window (click to enlarge)

Payment processing is done by calling the payment window directly on the page with the "Pay now" button (so-called "inline payment"). No redirection outside of the site occurs, which increases trustworthiness of transaction from user's view. The company states that the probability of completing the transaction in the case of an inline payment is approximately by 10% higher. The only exception may occur in case user does not have third party cookies enabled. A redirect will occur in such a case and the user will see blank background instead of his order page in the background - though the payment window looks the same as without redirection.

Once the payment window displayed, the procedure is similar to any payment - user selects payment method (credit card, internet banking or offline) and after providing payment details and verifying his identity, the payment will be processed. If the payment is successful, a success message will appear and the user can download or send to his email payment receipt (invoice).

How much will charge you payment gateway?

GoPay charges a fee for each payment received 0.90% - 2.20% + a fixed fee 0.11 € for each transaction. The fee amount depends on several factors, e.g. assumed monthly turnover on merchant account, average sum paid, who is the issuer of the payment card, etc.

In our experience, it is quite difficult to know and verify the fees charged - but this is also the case with other providers. The list of fees is available at company site .

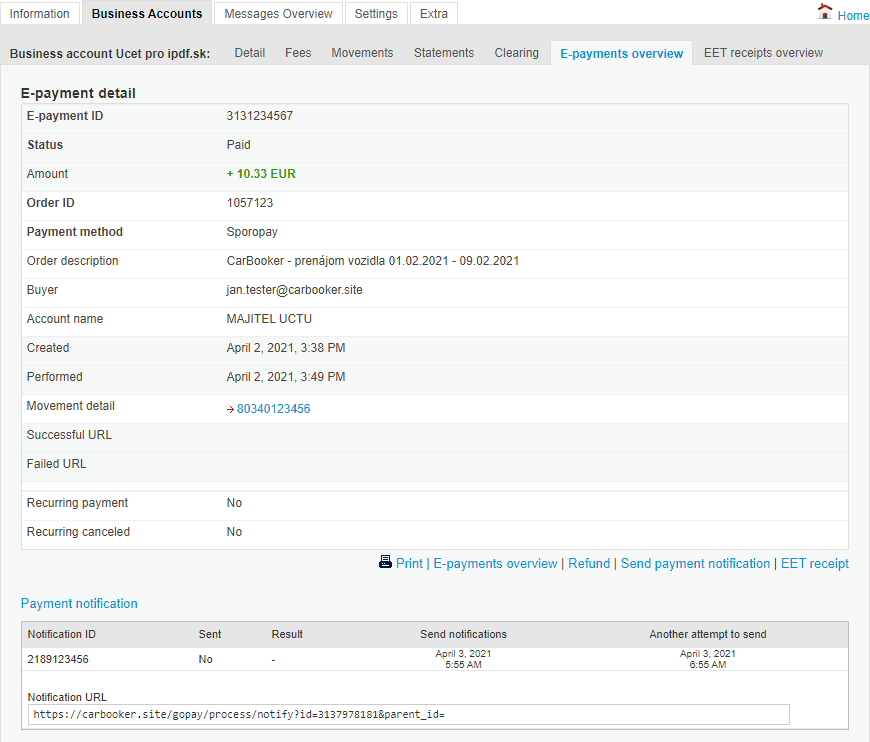

Merchant account

When choosing payment gateway, features of merchant's account is also an important criterion. Unfortunately, merchant almost never has the opportunity to see what functionalities he finds there before signing the Contract (or being granted with the access). This is not quite correct, and payment gateway providers should describe the merchant account in the documentation on their site just like the API SDK documentation.

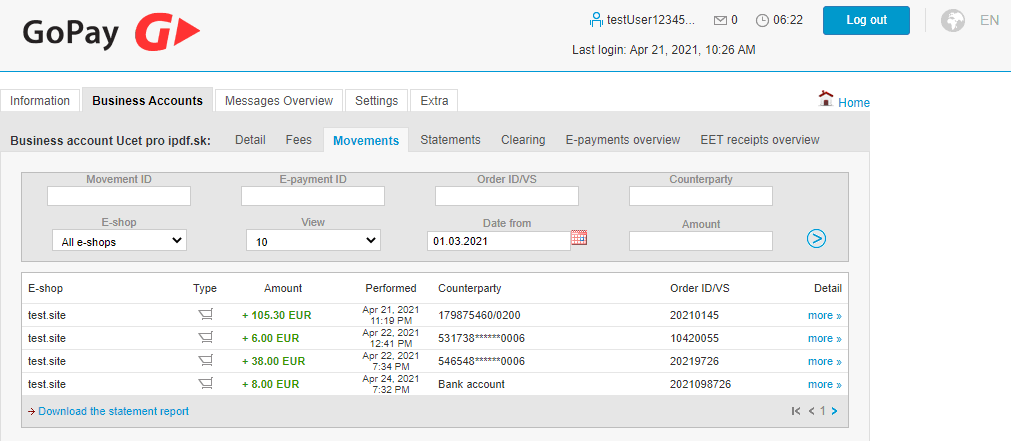

Of course, there should be overviews of received payments, account statements and exports in various formats, ability to display transaction details with the reason of failure in case of an unsuccessful payment, so that the merchant can inform his customer why the payment was rejected. It is also important to clarify how the transfer of funds to the merchant's bank account is carried out (clearing) - whether it is automated or manual clearing, what is the minimum account balance, etc.

Fig. 2 - GoPay - peek into a merchant account (click to enlarge)